Effective October 16, 2023, Lincoln is making updates to the Lincoln WealthAccelerate® IUL life insurance product. Lincoln WealthAccelerate® IUL – 10/16/23 will replace Lincoln WealthAccelerate® IUL.

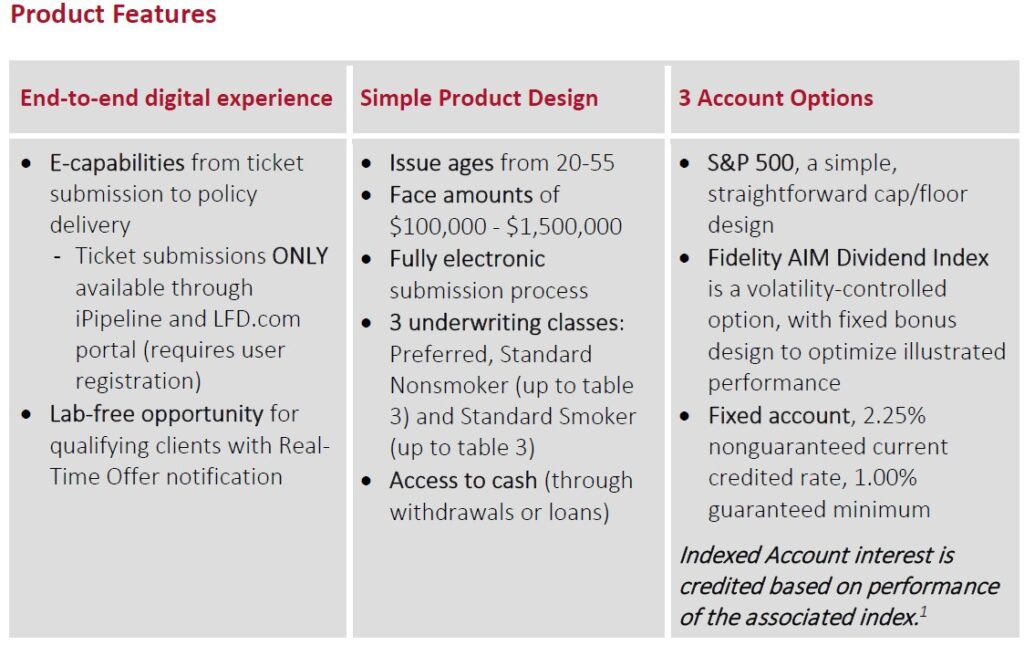

Lincoln WealthAccelerate® IUL -10/16/23 is a flexible premium universal life insurance product that offers a death benefit with flexibility for growth, access to cash value and financial protection, with an emphasis on the digital and automated experience from application to policy management.

Summary of changes

- Fidelity AIM® Dividend – Fixed Bonus participation rate increased to 155% (from 140%)

- Removed excess premium loads (current charge only)

- Cost of Insurance increase and duration of charge extended to age 121

- Target premium decrease of 5% on Level Death Benefit Option (DBO1)

- Minimum Premium Requirement Increase

Access to Living Benefits*

Critical Illness Rider

- Covers 8 critical illnesses

- Maximum single acceleration of lesser of $50,0000 or 25% of specified amount

- Maximum lifetime acceleration of lesser of $500,000 or 80% of specified amount

Chronic Illness Rider (Lincoln LifeAssure® Accelerated Benefits Rider II)

- Requires application supplement

- Covers both permanent and temporary chronic illness

- Annual or monthly payment options

- Maximum lifetime acceleration of lesser of $1.5 million or 100% of specified amount

*Combined Maximum benefit is lesser of specified amount or $1.5M

Transition Guidelines

New business applications for Lincoln WealthAccelerate® IUL – 10/16/23 will be accepted on October 16, 2023, pending firm and state approval. For states approved at rollout, the transition period begins on October 16, 2023 and ends on November 15, 2023.

- Applications for the Lincoln WealthAccelerate® IUL must be signed, dated and received in good order in Lincoln’s home office by the end of the transition period to qualify.

- For cases with the owner listed as “Trust to be Established”, formal applications received in the Home Office by the end of the transition period and have been signed by the insured will still qualify as awaiting a trust to be set up is part of the normal course of business. The only paperwork that Lincoln will not require at submission is the executed Certification of Trustee Powers with the trustee/owner’s signature. It must be received prior to issue.

- For formal applications that expire prior to Issue or have been closed out, a new Part I must be submitted, and the case will be subject to the rates available at that time.

- For pending business or policies already issued, Lincoln will accept a written request and a revised illustration to change to Lincoln WealthAccelerate® IUL – 10/16/23.

- For policies already placed, normal internal replacement guidelines apply. Rewrites will not be allowed.

State Availability

All states will be approved at launch with the exception of NY where the product is not offered.