The large case market is an important segment of our business. Beginning May 16, you will no longer need to contact Prudential home office for a large case illustration. PruLife Illustrator and Winflex web will be updated to allow all users to run large premium illustrations. A splash page reminder will be added to the illustration, noting that home office review and approval will be required before submitting business for premiums over the current limit.

Does the premium limit apply to all policies for an insured?

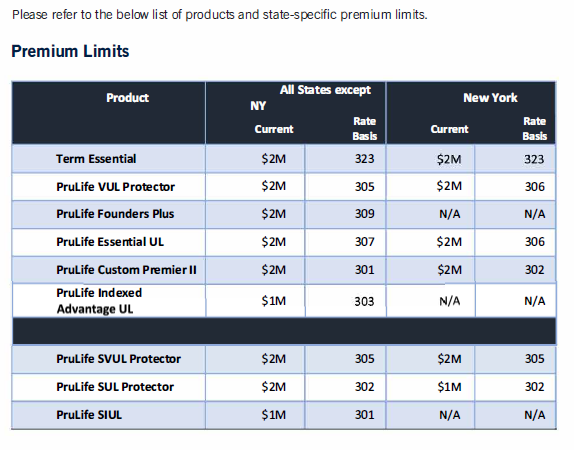

Yes, this limit applies across all cases for an individual insured. Each insured will be allowed a total limit of $2,000,000 (or the specific limit for the product/state as listed above if lower). This will allow for a single insured to submit up to a product/state specific limit in total combined premium, including premiums paid on policies placed over the last 12 months. It will also impact policies applied for in the next 12 months.

Example #1

Client has not applied for coverage in the last 12 months, he or she can apply for a VUL Protector policy with a planned premium of $2,000,000 per year.

Example #2

Client took out a policy in the last 12 months and paid a premium of $1,000,000 consistent with the previous premium limits. They are interested in obtaining additional coverage with a new VUL Protector policy. They can apply for a policy with a planned premium of an additional $1,000,000.

Example #3

Clients are looking to put in the maximum premium allowable in Pru life SVUL Protector, in combination with individual coverage. The maximum allowable premium for SVUL is $2M, which would be attributable half to each insured. The remaining $1.0M could be used to purchase individual coverage, such as Prulife VUL Protector.

What type of funding counts toward the premium limit?

All funding will count toward the new premium limit. This includes the combined total of all 1035 exchanges, lump sum payments, and any additional premium made toward a policy for each individual insured. Planned premiums for policies as part of a Term Conversion also count towards the cumulative premium limit for an individual insured. If the conversion is part of a non-contractual conversion, such as when an optional rider is added, the face amount is being increased, or the conversion is to a survivorship policy, then the premium limit would be enforced on the new policy.

If a new term policy is going to be placed to bind coverage with the intent to convert the policy in the near future, the case should be submitted for review (prior to placing the term policy) based on the ultimate permanent policy case design if the premium will exceed the premium restriction of the product.

Will inforce policies count toward the premium limit?

Yes, existing policies placed over the last 12 months will count toward the premium limit. All new policies and new submissions will count toward the insured’s total limit for the policy year.

Are these limits subject to change?

Yes, existing Prudential will continue to monitor the current marketplace to determine if updates are needed to these premium limits.

Is there a Large Case Review process to consider cases that exceed the premium limits?

Yes, there is a Large Case Review process, which allows us to closely monitor large case activity and ensure we are placing cases that meet our desired profitability objectives and risk tolerance levels. Policies exceeding the allowable premium limits, including term conversions, may be available by exception or by exception with a reduction in commission. Products that have a $2,000,000 premium limit will be eligible for review. Older versions of products that haven’t approved the latest pricing and have lower limits will not be eligible.