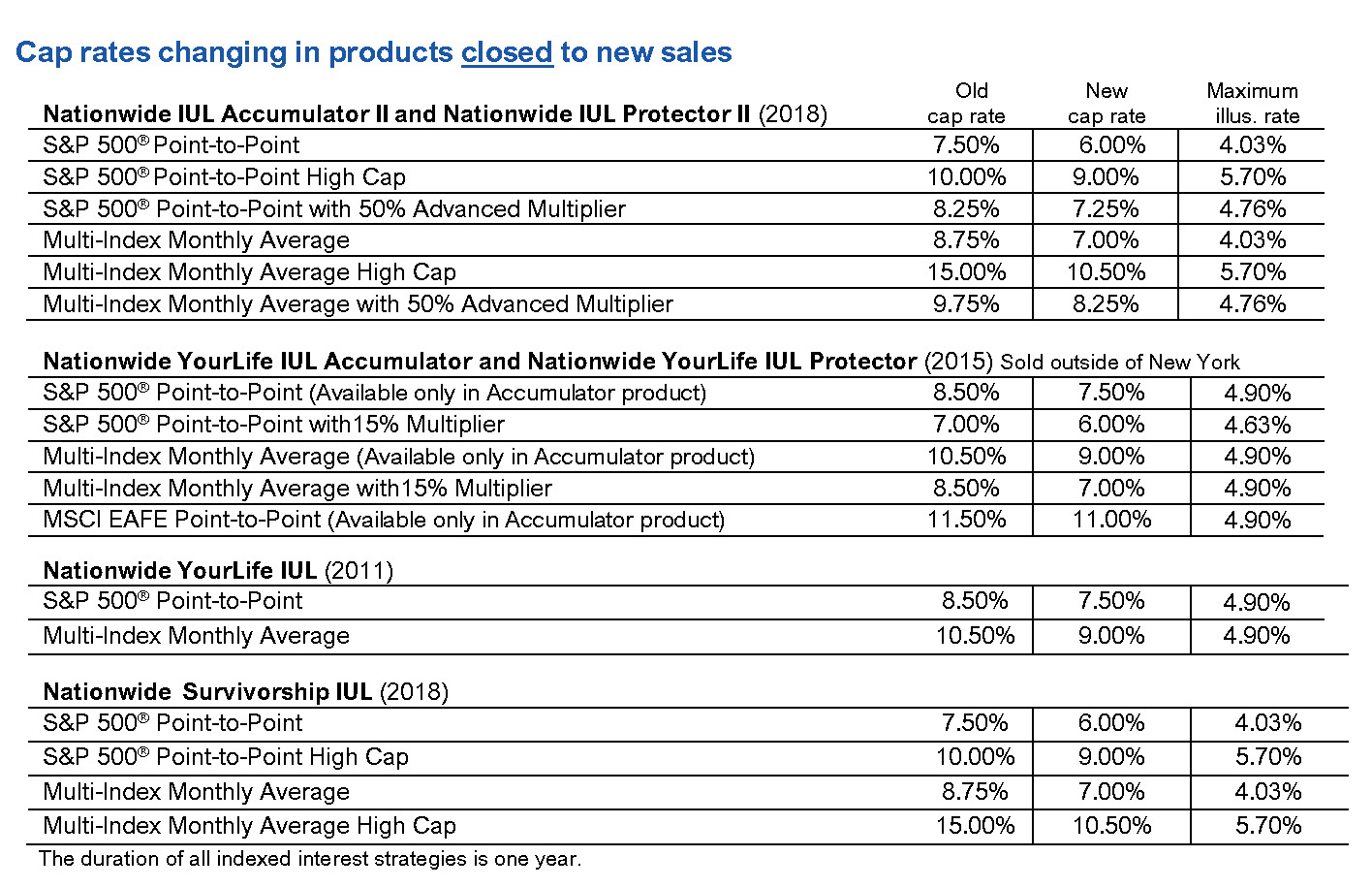

Indexed Universal Life and Variable Universal Life Cap Rate Changes Effective January 15, 2022

Nationwide is committed to carefully managing our life product portfolio to remain the strong, stable carrier insurance professionals and their clients have always relied on. To keep that commitment ⎯ and in response to persistently low interest rates and increased cost of hedging ⎯ we are decreasing the cap rate on indexed interest strategies in our IUL and VUL products. No changes apply to any spread, participation or floor rates.

We could avoid cap rate decreases by charging more for our products from the start, but our philosophy is to keep costs low. While this necessitates adjusting cap rates periodically, low costs are a better value for the customer and provide greater transparency.

Important dates

- December 3, 2021: Life illustration software will be updated with new cap rates and new maximum illustrative rates.

- December 15, 2021: Segments created on this date will receive the old cap rates; policies must be in force and premium and/or transfer instructions received at Nationwide no later than this date to receive the old rates.

- December 16, 2021: Illustrations must be run on the updated software (version 4.26).

- January 15, 2022: Segments created on this date or later will be subject to the new cap rates.

- February 28, 2022: Policies must be funded and in force in order to use a matching illustration run on the previous version of the illustration software.

Please keep in mind

- The cap rate changes apply to all in-force policies and new business, as well as new premium, transfers (including DCA) and reallocations of matured segments.

- Illustrations run on or after December 3, 2021, will be subject to new maximum illustrative rates. These rates will be available in the illustration software on December 3, 2021.

a. Illustrations run on the prior software version and received before December 16, 2021, will still be accepted for policies placed in force after that date, but they must match the offer and be funded by February 28, 2022.

b. Any illustration, including revised illustrations, received on or after December 16, 2021, must be run in the updated version of the illustration software (4.26). - Policyholders will see the revised cap rates starting December 16, 2021, if they access their policy information online.

What is not changing

- No change to any spread, participation or floor rates

- No change to our low-cost structure

- No change to cost of insurance (COI) rates on in-force policies

- No change to our guaranteed Multipliers, available in our IUL products introduced in 2015 and 2018

- No change to our guaranteed Nationwide IUL Rewards Program® or Nationwide VUL Rewards Program®

- No change to our cash indemnity Long-term Care Rider II with benefits that can be used for home care

Nationwide’s history of strong IUL solutions

For our first IUL, launched in 2011, the annual average crediting rate for the Multi-index Monthly Average strategy is 8.66%; for our core S&P 500® strategy it’s 8.48%. Both are well above the maximum illustrative rate of any of our IUL products. While past performance is no guarantee of future performance, these rates help demonstrate the value of our IUL solutions.

Why IUL now

IUL offers growth potential through participation in the market without being in the market, while providing protection against negative crediting rates with a guaranteed 0% floor rate. Unlike whole life and current assumption universal life, the interest rate in IUL is based on the market – and not left solely to the discretion of the life insurance carrier.