Effective May 10, 2021, Lincoln is pleased to announce an update to the Lincoln WealthPreserve® 2 IUL (2020) life insurance product. This new product update also incorporates the new 7702 assumptions that were effective January 1, 2021.

Lincoln WealthPreserve® 2 IUL (2020) – 05/10/21 offers flexibility for growth, access to cash value, and financial protection. Built for clients who want valuable guaranteed protection with flexibility for life’s changing needs.

Product Highlights

Provides Clients Choices Today and in the Future

New! Introducing the Fidelity AIM® Dividend Indexed Account – Fixed Bonus.

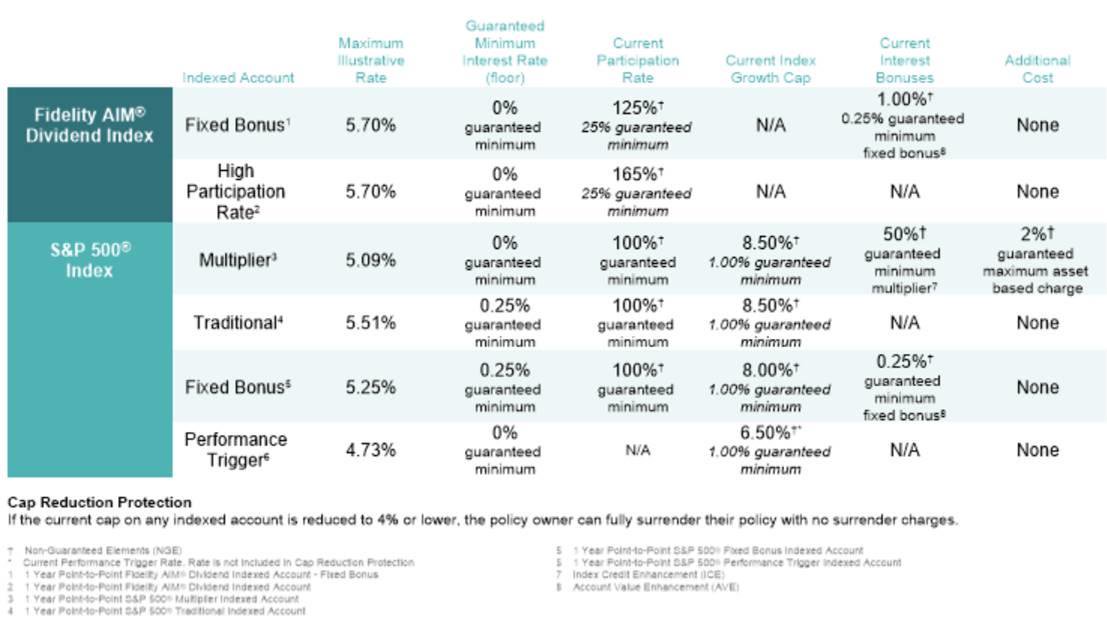

In addition to the 5 currently available account choices, the new Fidelity Account with a Fixed Bonus offers strong uncapped growth potential and a guaranteed bonus regardless of the underlying index performance. Policy value can be allocated to one or more account options with the ability to make allocation changes in the future. Indexed account options are linked to the S&P 500® Index* (excluding dividends) or the Fidelity AIM® Dividend Index# designed to provide options to help meet clients’ long-term goals based on return potential and downside protection preferences.

Guaranteed Financial Protection

- Extended guaranteed death benefit protection for up to 40 years or to age 901 (whichever comes first)

- Guaranteed cap reduction protection means surrender charges are waived if the indexed account cap is reduced to 4% or lower (Does not include the Performance Trigger Account)

- Access to cash value through loans, with guaranteed interest loan charge rates for the duration of the policy

Access to Cash Value

- 14-year surrender charge period

- Tax-advantaged distribution potential that may provide an additional financial resource or supplement existing retirement income. Choices provide a competitive option in the accumulation/distribution Indexed Universal Life (IUL) marketplace:

- Withdrawals

- Fixed and Participating loan options with guaranteed loan charge rates for greater cash flow predictability

Flexibility to Keep Up with Your Clients’ Changing Needs

- Policy value growth linked to S&P 500® Index or the Fidelity AIM® Dividend Index performance with a guaranteed minimum crediting rate, which varies by Indexed Account chosen

- A simple approach to death benefit guarantee catch-up premiums1 means your client’s can pay the intended premium at any time and keep their death benefit guarantee intact

Secure the Added Protection of a Living Benefit

Choice of chronic care riders:

- Lincoln LifeAssure® Accelerated Benefits Rider provides a no upfront cost benefit with a discounted benefit upon qualification of a permanent chronic illness

- Lincoln Care Coverage® Accelerated Benefits Rider (in approved states) provides access to a known benefit amount for an additional cost, upon qualification of a permanent chronic illness

- Lincoln LifeEnhance® Accelerated Benefits Rider provides access to a known benefit amount for an additional cost, upon qualification of a permanent chronic illness (replaced by CCABR in approved states)

Transition Guidelines

Lincoln WealthPreserve® 2 IUL (2020) – 05/10/21 will replace Lincoln WealthPreserve® 2 IUL (2020). For states that are approved at rollout there is a 60-day transition period which begins on May 10, 2021, and ends on July 9, 2021

- For the replaced product, formal applications must be signed, dated and received in-good-order in Lincoln’s home office by the end of the transition period to qualify. For LincXpress® Tele-App Cases, a complete ticket and required solicitation forms must be received.

- For pending business or policies already issued, Lincoln will accept a written request and a revised illustration to change to the Lincoln WealthPreserve® 2 IUL (2020) – 05/10/21.

- For policies already placed, normal internal replacement guidelines apply. Rewrites will not be allowed.

- For states approved after rollout, the above will automatically apply based on the availability date.

1 Minimum premium requirement must be met to maintain the Extended No-Lapse Minimum Premium Rider. Only available with DBO1 and maximum issue age of 64.