New rates with more options to save and earn for healthy living.

Effective today, John Hancock is updating its Term portfolio.

What’s changing?

- New rates

- 4% rate increase due to the recent US tax reform

- New monthly modal factors and policy fee

- New choice

- Now Vitality rider can be added to the base Term product

What’s the difference between the new Term & optional Vitality rider and the existing Term with built-in Vitality? Customer premiums will never increase with the new option.

NEW OPPORTUNITY FOR VITALITY: Term & optional Vitality rider

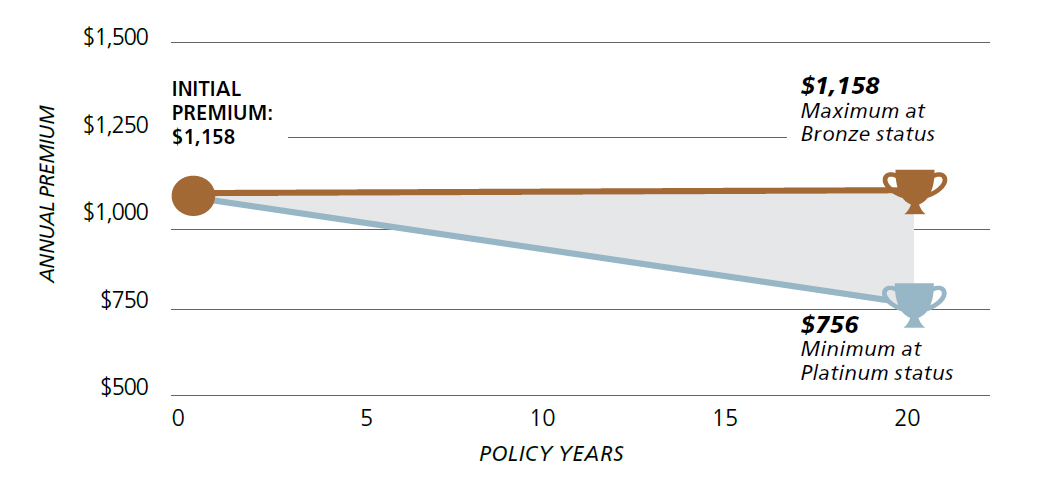

Competitive premiums that will only decrease when clients engage in Vitality

This example is based on male, age 45, best risk class, $1M face amount, 20-year term duration, and shows the potential minimum and maximum premiums based on Vitality Status earned. The shaded area represents the range of possible premiums.

Don’t forget, the John Hancock Term portfolio continues to offer a competitive conversion option, and supplementary riders such as an Accelerate Benefit, Unemployment Protection, and Total Disability Waiver. Your clients can also continue to choose John Hancock Term with Vitality, which has the Vitality benefit built into the policy.

State approvals and illustration system

The new Vitality ride is approved in all states except California, New York, and North Dakota. Please refer to the state approval map for most current state approvals. JHIllustrator will be updated as states are approved.

New business and underwriting information

May 25, 2018

- New Applications for Term policies with old rates must be received by John Hancock’s home office by May 25, 2018. Applications received May 2, 2018, and later will be issued with the new rates.

June 22, 2018

- To issue policies will old rates, all pending applications must complete the formal underwriting process and all administrative requirements must be received by John Hancock by June 22, 2018.

Please contact your Case Manager should you already have a pending application in New Business and wish to have the new rates. Coinciding with the launch of the new rates, new applications received at our service office prior to May 26th that do not specify the version of rates applied for will be set up with new rates. On pending cases submitted during the transition period, please contact your Case Manager to make any changes to the product selected.

Reissues

Recently issued policies can be considered for reissue, with the new rates, provided the “free look” period has not expired. Make sure to indicate that you want the policy reissued with the new rates. Subject to normal underwriting practices, polices may require additional evidence to ensure health status has not changed.

Inforce cases

Term-to-Term replacements are not allowed within the first policy year. Any replacement of an inforce policy (after the first policy year) would require replacement forms, be subject to full underwriting, and possibly result in reduced compensation. Please not that the six-month product exchange feature is not available on John Hancock Term products.