Show your UL clients how our newly repriced Protection UL continues to stand out against GUL competitors — making it a clear choice for customers seeking:

- Industry-leading pricing, especially for short- and single-pay scenarios

- Strong no-lapse guarantees with attractive cash value potential, particularly compared to guaranteed UL products

- New Cash Value Enhancement rider and Preliminary Funding Account for added flexibility

- Potential for even lower premiums for healthy living — plus additional rewards — with Vitality PLUS

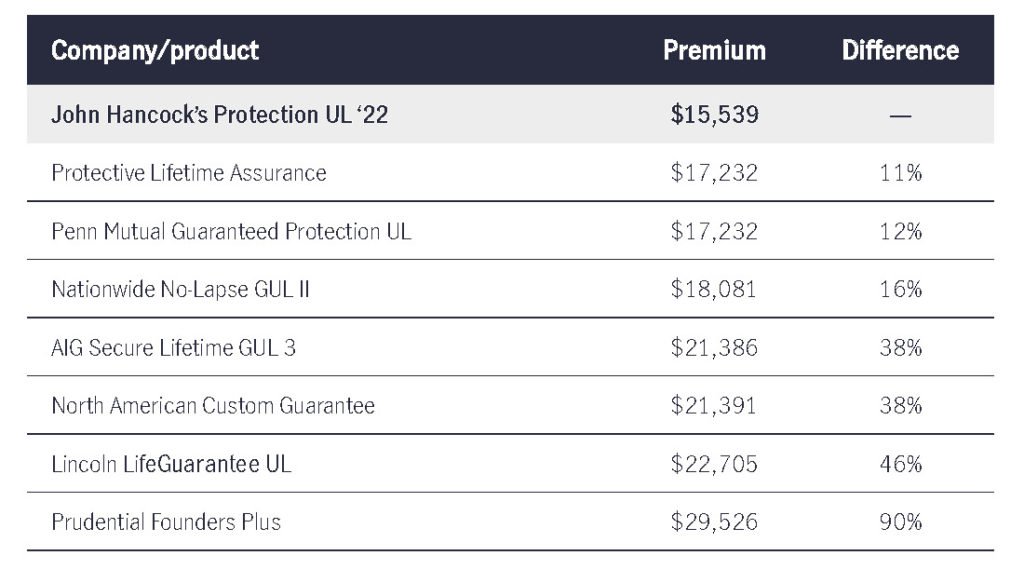

See how Protection UL delivers significant premium savings

Male, 60, Preferred Non-Smoker, level pay, $1 million death benefit

New business and underwriting information

March 11, 2022

- If seeking an informal offer — the John Hancock home office must receive a Protection UL ‘19 illustration signed by the insured and owner, and a tentative underwriting decision must be obtained by this date.

- If seeking a formal offer — the John Hancock home office must receive a Protection UL ‘19 application signed by the insured and owner by this date. An illustration on the case is also required.

- For a term conversion — the John Hancock home office must receive a term conversion application signed by the insured and owner by this date.

- Note: If the policy is to be trust owned, at a minimum the insured’s signature is required on the application by this date.

May 6, 2022

- By this date, John Hancock must have provided a final underwriting offer, received all administrative requirements to issue the policy and received confirmation to proceed with the 1035 Exchange (if applicable).

Inforce cases

Please consult John Hancock’s Internal Replacement Guidelines if you have a client considering replacing their existing John Hancock coverage.