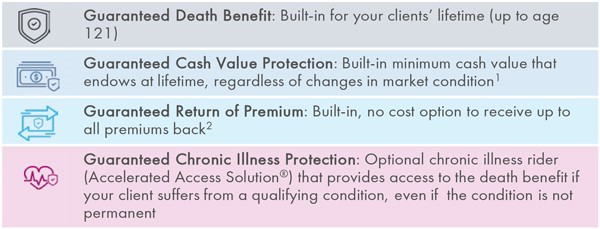

Effective September 30, 2019, Platinum Choice VUL 2 will be redesigned using the 2017 CSO Mortality Tables and to provide your clients with more guarantees, no matter how markets perform:

CSO Update

As of January 1, 2020, all life insurance policies are required to use the updated 2017 CSO Mortality Tables. To receive the 2001 CSO compliant AG Platinum Choice VUL 2 product, new applications must be signed prior to September 30, 2019, and received in the home office no later than 3 PM Central Time on October 11, 2019.

Transition Rules

- Effective September 30, 2019, the Platinum Choice VUL 2 (new) product will be available.

- To receive AG Platinum Choice VUL 2 (old), new applications must be signed prior to September 30, 2019, and received in the home office no later than 3 PM CT, October 11, 2019.

- After 3 PM CT on October 11, 2019, any application received for AG Platinum Choice VUL 2 (old) will be issued with Platinum Choice VUL 2 (new).

- A new illustration and VUL Supplemental Application will be required for the Platinum Choice VUL 2 (new).

- After 3 PM CT on October 11, 2019, any AG Platinum Choice VUL 2 (old) application received to replace an existing product will be issued with Platinum Choice VUL 2 (new).

- A new illustration, VUL Supplemental Application and replacement paperwork for the Platinum Choice VUL 2 (new) will be required.

Any application with a signed date on or after September 30, 2019, will be issued with the Platinum Choice VUL 2 (new).

- A new illustration, VUL Supplemental Application and replacement paperwork for the Platinum Choice VUL 2 (new) will be required.

- Reissue requests to change VUL products will not be honored.

- New applications submitted to replace existing inforce coverage with the new product will not be honored within 90 days of the existing coverage going inforce.

- Applications for the AG Platinum Choice VUL 2 (old) product received in good order by 3 PM CT October 11, 2019, must be paid and inforce by December 31, 2019, or a new illustration and VUL Supplemental Application will be required and the Platinum Choice VUL 2 (new) product will be issued.

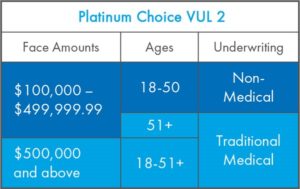

In addition to its comprehensive guarantees Platinum Choice VUL 2 continues to offer:

- Non-medical underwriting3

- Ages 18-50 under $500,000 (up to $499,999)

- Up to the best underwriting class available4

-

- 46 variable investment options from renowned money managers

- Consumer-friendly Auto-rebalancing and Dollar Cost Averaging programs available

- Optional customizable riders to meet your clients’ specific needs.5

Ideal for individuals seeking competitively priced death benefit guarantees with market-driven upside potential.

Important Disclosures

Information contained herein is subject to completion or amendment. A prospectus for this product has been filed with the Securities and Exchange Commission and is under review. This product and features being discussed may change depending on SEC guidance. This product cannot be offered or sold until the prospectus is declared effective by the SEC. This communication shall not constitute an offer to sell nor the solicitation of a sale as it would be unlawful to do so prior to the registration or qualification under the securities law of any such State.

1 The Guaranteed Minimum Cash Value Rider (“GMCV Rider”) is only available through full surrender and cannot be used for loans, withdrawals or to satisfy monthly deductions. The GMCV will not be paid in addition to the cash surrender value.

2 If the policy is surrendered at the end of policy year 20 receive 50% of premiums paid, or at the end of policy year 25 receive 100% of premiums paid, up to 40% of face amount.

3 “Non-Medical Underwriting” or “Non-Med” as described in this document, means that no in-person paramedical examination will be required of an applicant for life insurance.

4 No flat extra ratings are available for this non-medical underwriting program. Our underwriting team renders a decision based on the submitted applications, declarations of Part A and B, supplementary forms, and result of various database searches.

5 Review the Platinum Choice VUL 2 Prospectus when available for complete rider details. There may be separate charges for each rider. All riders are not available in all states.

Important Consumer Disclosures Regarding Accelerated Benefit Riders

An Accelerated Death Benefit Rider (ABR) is not a replacement for Long Term Care Insurance (LTCI). It is a life insurance benefit that gives you the option to accelerate some of the death benefit in the event the insured meets the criteria for a qualifying event described in the policy. The rider does not provide long-term care insurance subject to California insurance law, is not a California Partnership for Long-Term Care program policy. The policy is not a Medicare supplement.

ABRs and LTCI provide different types of benefits. An ABR allows the insured to access a portion of the life insurance policy’s death benefit while living. ABR payments are unrestricted and may be used for any purpose. LTCI provides reimbursement for necessary care received due to the inability to perform activities of daily living or cognitive impairment. LTCI coverage may include reimbursement for the cost of a nursing home, assisted living, home health care, homemaker services, adult daycare, hospice services or respite care for the primary caretaker and the benefits may be conditioned on certain requirements or meeting an elimination period or limited by type of service, the number of days or a maximum dollar limit. Some ABRs and all LTCI are conditioned upon the insured not being able to perform two or more of the activities of daily living or being cognitively impaired.

This ABR pays proceeds that are intended to qualify for favorable tax treatment under section 101(g) of the Internal Revenue Code. The federal, state, or local tax consequences resulting from payment of an ABR will depend on the specific facts and circumstances, and consequently, advice and guidance should be obtained from a personal tax advisor prior to the receipt of any payments. ABR payments may affect eligibility for, or amounts of, Medicaid or other benefits provided by federal, state, or local government. Death benefits and policy values, such as cash values, premium payments and cost of insurance charges if applicable, will be reduced if an ABR payment is made. ABR payments may be limited by the contract or by outstanding policy loans.