Effective December 9, 2022, Asset Care premiums are going down again. This means more client benefits for the same premium dollars.

- Life insurance premiums changing only; no change on Continuation of Benefits (COB) premiums

- “Package premiums” (i.e., base + COB) reduced 5-10 percent for most scenarios

- Quoting is not available until Dec. 9

Transition Rules

Dec. 9, 2022

The Asset Care price decrease goes into effect on all cases issued on or after Dec. 9, 2022. This will impact the following Asset Care product portfolio funding options:

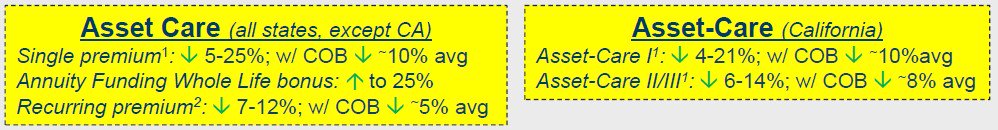

All States except California

- Single Premium, including the Single Premium Drop-in Rider

- Annuity Funding Whole Life: Income Benefit Rider Bonus increasing to 25%.

- Recurring Premium: 5-pay and 10- pay only; No change on 20-pay or pay-to-95.

California

- Asset-Care I

- Asset-Care II/III

- Asset-Care IV: No Change

Cases issued between Nov. 9 – Dec. 9, 2022 eligible for new pricing

Dec. 9, 2022

- Quote software reflects new pricing. Neither the software nor the home office can generate quotes with the new

pricing prior to this date. - Advisors may begin submitting requests to reissue eligible policies via email or OneSource Online. Sending a

new, unsigned illustration with the request is preferred but not required. - Reissue requests will be worked as quickly as possible. It is our desire to maintain service levels on all new

applications, so reissue requests pertaining to this price change may fall outside our normal service standards.

By Dec. 20, 2022

- Requests for reissue must be received by OneAmerica® no later than Dec. 20, 2022 via email or OneSource

Online. Sending a new, unsigned illustration with the request is preferred but not required.

Important Notes:

- Commission statements will reflect a chargeback when the original policy is terminated. The commission for the

new policy will then be applied when processing is complete. - New policy pages will be generated, and new delivery requirements will apply as well. These must be signed by

the applicant and returned to the home office as directed.

Note: Policies and long-term care insurance riders are underwritten by The State Life Insurance Company® (State

Life), Indianapolis, IN, a OneAmerica company that offers the Care Solutions product suite. Asset Care form

numbers: ICC18 L302, ICC18 L302 SP, ICC18 L302 JT, ICC18 L302 SP JT, ICC18 SA39; ICC18 R537, ICC18,

R538, ICC18 R540 and L302, L302 SP, L302 JT, L302 SP JT, SA39; R537, R538, R540; Asset-Care Form numbers

L301(CA), R501(CA) & SA31(CA). Not available in all states or may vary by state.