Nationwide is committed to carefully managing our life product portfolio to remain the strong, stable carrier you can rely on. To keep this commitment, and in response to the extremely low interest rate environment and volatility in the markets, we are lowering the interest rate on the fixed account in select products.

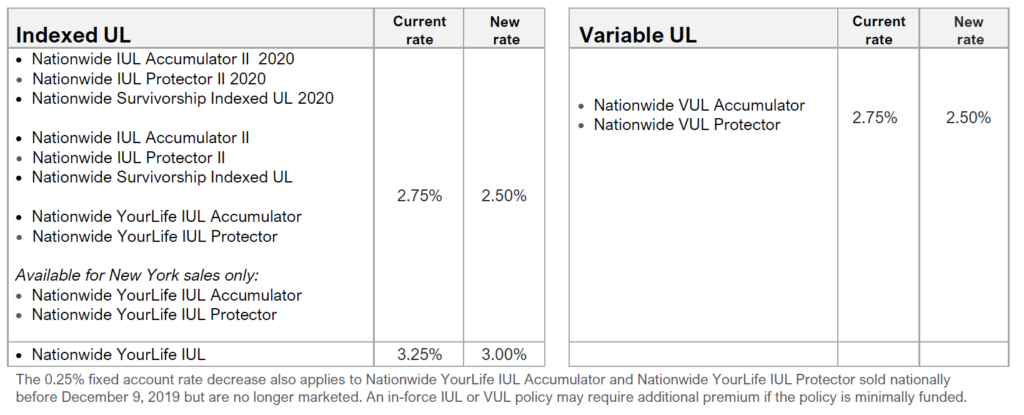

IUL and VUL fixed account 0.25% rate decrease effective July 1, 2021

The 0.25% fixed account rate change applies to both in-force and new policies for the following IUL and VUL products.

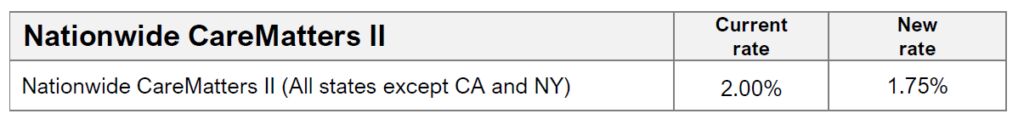

Nationwide CareMatters® II fixed account 0.25% rate decrease effective July 1, 2021

The rate credited to the Nationwide CareMatters II fixed account is decreasing by 0.25% and applies to both in-force and new policies. This change does not impact premiums. CareMatters illustrations are shown on a guaranteed basis only. If premiums are paid and no loans or partial surrenders are taken, the benefits are guaranteed. The Nationwide YourLife CareMatters (CA and NY) fixed account rate remains unchanged.

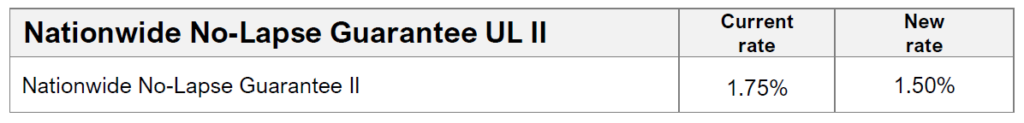

No-Lapse Guarantee UL II fixed account 0.25% rate decrease effective July 1, 2021

The rate credited to the Nationwide No-Lapse Guarantee UL II fixed account is decreasing by 0.25% and applies to both in-force and new policies. The fixed account rate remains unchanged for the Nationwide YourLife No-Lapse Guarantee UL.

Honoring our commitments

By carefully managing our diverse life product portfolio, we have been able to consistently honor our commitments, even in times of economic disruption. We remain strongly committed to serving you and your clients’ life insurance needs. Thank you for putting your trust in Nationwide.

Markets.