Effective May 16, 2022, subject to state availability, Lincoln is pleased to introduce Lincoln WealthPreserve® 2 Survivorship IUL (2022) to our life insurance portfolio.

Lincoln WealthPreserve® 2 Survivorship IUL (2022) offers long-term protection, built-in guarantees, and lifelong flexibility. Built for couples who want solid, cost-effective protection for two lives under one policy.

Product Highlights

Guaranteed Financial Protection

- Extended guaranteed death benefit protection for up to younger insureds age 95 for issue ages 55+ or younger insureds age 90 for issue ages 50 and below.

- A simple approach to death benefit guarantee catch-up premiums1 means your clients can pay the intended premium at any time and keep their death benefit guarantee intact.

- Access to cash value through loans, with guaranteed interest loan charge rates for the duration of the policy.

Optional Benefit for Protection

New! Introducing the Supplemental Increase Rider: Helps protect against cost-of-living increases by automatically growing the policy’s coverage amount by 3% of the initial specified amount each year, beginning in the second policy year.

- Unless terminated earlier, the rider is in effect to age 80 of the younger insured or until the maximum benefit amount is reached. The maximum benefit from this rider may not exceed two times the initial specified amount or $50 million.

- There is no specified charge for this rider, however the cost of insurance charges will reflect the higher coverage amount. ▪ Only available with Level Death Benefit Option (DBO1), not allowed with Extended No-Lapse Minimum Premium Rider.

Provides Clients Choices Today and in the Future

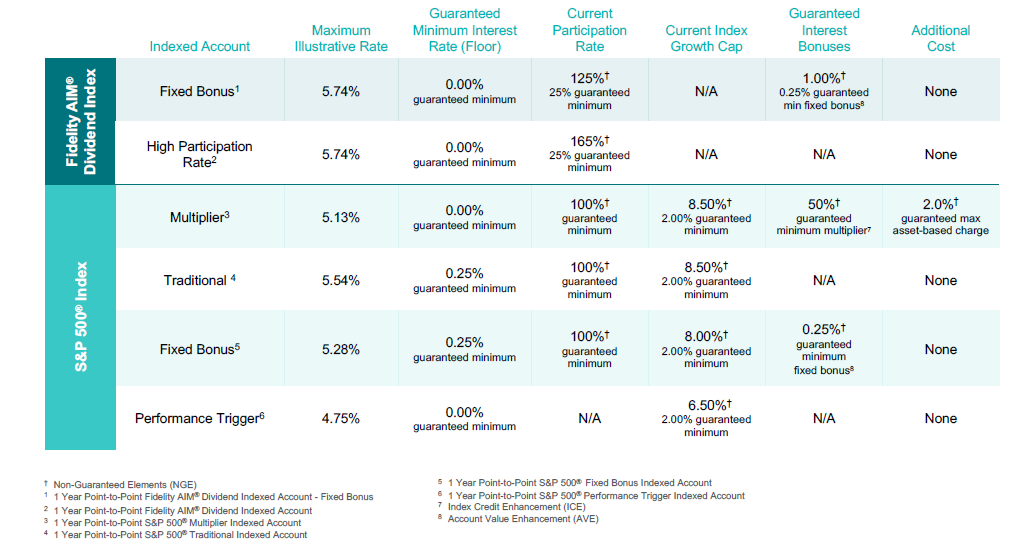

Choice of six indexed account options linked to the S&P 500® Index* (excluding dividends) or the Fidelity AIM® Dividend Index# designed to provide options to help meet clients’ long-term goals based on return potential and downside protection preferences. Policy value can be allocated to one or more account options with the ability to make allocation changes in the future.

Access to Cash Value

- 15-year surrender charge period

- Tax-advantaged distribution potential that may provide an additional financial resource or supplement existing retirement income. Choices provide a competitive option in the accumulation/distribution Indexed Universal Life (IUL) marketplace:

o Withdrawals

o Fixed and Participating loan options with guaranteed loan charge rates for greater cash flow predictability

Product Availability

New business applications will be accepted on May 16, 2022, in approved states. Click here to view the current Indexed Universal Life Product Availability Grid.